Availability: Note that this invoice integration is no longer available in Sweden. If you are a Swedish merchant and wish to offer invoice as a payment option, this has to be done through our payment order implementation.

Introduction

Seamless View provides an integration of the payment process directly on your

website. This solution offers a smooth shopping experience with Swedbank Pay

payment pages seamlessly integrated in an iframe on your website. The payer

does not need to leave your webpage, since we are handling the payment in the

iframe on your page.

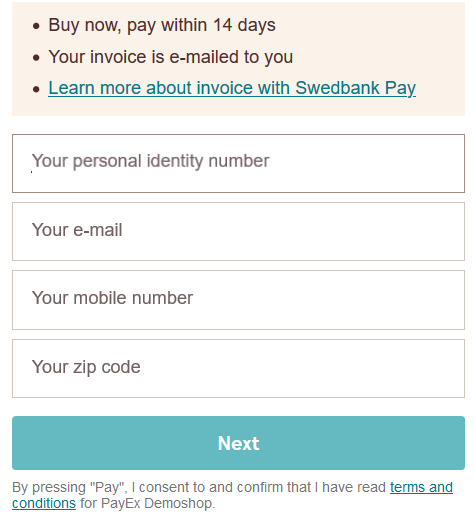

How It Looks

Callback URL: It is mandatory to set a callbackUrl in the POST

request creating the payment. When callbackUrl is set, Swedbank Pay will send

a POST request to this URL when the payer has fulfilled the payment. Upon

receiving this POST request, a subsequent GET request towards the id of

the payment generated initially must be made to receive the state of the

transaction.

Step 1: Create The Payment

GDPR: GDPR

sensitive data such as email, phone numbers and social security numbers must

not be used directly in request fields such as payerReference. If it is

necessary to use GDPR sensitive data, it must be hashed and then the hash can be

used in requests towards Swedbank Pay.

A FinancingConsumer payment is a straightforward way to invoice a

payer. It is followed up by posting a capture, cancellation or reversal

transaction.

An example of an abbreviated POST request is provided below. Each individual

field of the JSON document is described in the following section. An example of

an expanded POST request is available in the other features

section.

When properly set up in your merchant/webshop site and the payer starts the

invoice process, you need to make a POST request towards Swedbank Pay with your

invoice information. This will generate a payment object with a unique

paymentID. You will receive a JavaScript source in response.

Seamless View Request

Request

1

2

3

POST /psp/invoice/payments HTTP/1.1

Authorization: Bearer <AccessToken>

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

{

"payment": {

"operation": "FinancingConsumer",

"intent": "Authorization",

"currency": "SEK",

"prices": [

{

"type": "Invoice",

"amount": 1500,

"vatAmount": 0

}

],

"description": "Test Invoice",

"userAgent": "Mozilla/5.0...",

"generatePaymentToken": false,

"paymentToken": ""

"language": "sv-SE",

"urls": {

"hosturls": [

"https://example.com"

],

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"callbackUrl": "https://example.com/payment-callback",

"termsOfServiceUrl": "https://example.com/payment-terms.pdf"

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "CD1234",

"payeeName": "Merchant1",

"productCategory": "A123"

},

"payer": {

"payerReference": "AB1234",

},

},

"invoice": {

"invoiceType": "PayExFinancingSe"

}

}

payment

object

check

payment object contains information about the specific payment.

operation

string

check

payment is supposed to perform. The FinancingConsumer operation is used in our example.

intent

string

check

currency

enum(string)

check

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

prices

object

check

prices resource lists the prices related to a specific payment.

type

string

check

Use the value ``.See the prices resource for more information.

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

check

A textual description of the purchase. Maximum length is 40 characters.

generatePaymentToken

boolean

true or false. Set this to true if you want to create a paymentToken for future use as One Click.

userAgent

string

check

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

enum(string)

check

Allowed locale code values: sv-SE, nb-NO or en-US.

urls

object

check

urlsresource lists urls that redirects users to relevant sites.

hostUrls

array

check

completeUrl

string

check

The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment to inspect it further. See completeUrl for details.

cancelUrl

string

paymentUrl; only cancelUrl or paymentUrl can be used, not both.

paymentUrl

string

The paymentUrl represents the URL that Swedbank Pay will redirect back to when the view-operation needs to be loaded, to inspect and act on the current status of the payment, such as when the payer is redirected out of the Seamless View (the <iframe>) and sent back after completing the payment. paymentUrl is only used in Seamless Views and should point to the page of where the Payment Order Seamless View is hosted. If both cancelUrl and paymentUrl is sent, the paymentUrl will used.

callbackUrl

string

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment. See callback for details.

termsOfServiceUrl

string

The URL to the terms of service document which the payer must accept in order to complete the payment. HTTPS is a requirement.

payeeInfo

object

check

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details.

payeeId

string

check

payeeReference

string(30)

check

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. In Invoice Payments payeeReference is used as an invoice/receipt number, if the receiptReference is not defined.

payeeName

string

productCategory

string(50)

orderReference

string(50)

payer

string

payer object, containing information about the payer.

payerReference

string

The reference to the payer from the merchant system, like e-mail address, mobile number, customer number etc. Mandatory if generateRecurrenceToken, RecurrenceToken, generatePaymentToken or paymentToken is true.

invoiceType

string

check

PayExFinancingSe, PayExFinancingNo or PayExFinancingFi depending on which country you're doing business with Swedbank Pay in. (Other external financing partner names must be agreed upon with Swedbank Pay.)Seamless View Response

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

{

"payment": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"number": 1234567890,

"instrument": "Invoice",

"created": "YYYY-MM-DDThh:mm:ssZ",

"updated": "YYYY-MM-DDThh:mm:ssZ",

"operation": "FinancingConsumer",

"intent": "Authorization",

"state": "Ready",

"currency": "SEK",

"prices": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/prices"

},

"amount": 0,

"description": "Test Purchase",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"urls": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/urls"

},

"payeeInfo": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payeeinfo"

},

"payers": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payers"

},

"metadata": {

"id": "/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/metadata"

}

},

"operations": [

{

"method": "POST",

"href": "https://api.externalintegration.payex.com/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/approvedlegaladdress",

"rel": "create-approved-legal-address",

"contentType": "application/json"

},

{

"method": "POST",

"href": "https://api.externalintegration.payex.com/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/authorizations",

"rel": "create-authorization",

"contentType": "application/json"

},

{

"method": "PATCH",

"href": "https://api.externalintegration.payex.com/psp/invoice/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"rel": "update-payment-abort",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/invoice/payments/authorize/5a17c24e-d459-4567-bbad-aa0f17a76119",

"rel": "redirect-authorization",

"contentType": "text/html"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/invoice/core/scripts/client/px.invoice.client.js?5a17c24e-d459-4567-bbad-aa0f17a76119&operation=authorize",

"rel": "view-authorization",

"contentType": "application/javascript"

}

]

}

The key information in the response is the view-authorization operation. You

will need to embed its href in a <script> element. The script will enable

loading the payment page in an iframe in our next step.

Please note that nested iframes (an iframe within an iframe) are unsupported.

Step 2: Display The Payment

You need to embed the script source on your site to create a Seamless View in an

iframe; so that the payer can enter the payment details in a secure Swedbank Pay

hosted environment. A simplified integration has these following steps:

- Create a container that will contain the Seamless View iframe:

<div id="swedbank-pay-seamless-view-page">. - Create a

<script>source within the container. Embed thehrefvalue obtained in thePOSTrequest in the<script>element. Example:

1

<script id="payment-page-script" src="https://ecom.externalintegration.payex.com/invoice/core/ scripts/client/px.invoice.client.js"></script>

The previous two steps gives this HTML:

HTML

1

2

3

4

5

6

7

8

9

10

11

12

13

<!DOCTYPE html>

<html>

<head>

<title>Swedbank Pay Seamless View is Awesome!</title>

<!-- Here you can specify your own javascript file -->

<script src=<YourJavaScriptFileHere>></script>

</head>

<body>

<div id="swedbank-pay-seamless-view-page">

<script id="payment-page-script" src="https://ecom.dev.payex.com/invoice/core/scripts/client/px.invoice.client.js"></script>

</div>

</body>

</html>

Loading The JavaScript

Lastly, initiate the Seamless View with a JavaScript call to open the iframe

embedded on your website.

HTML

1

2

3

4

5

6

7

<script language="javascript">

payex.hostedView.invoice({

// The container specifies which id the script will look for to host the

// iframe component.

container: "swedbank-pay-seamless-view-page"

}).open();

</script>

Purchase Flow

The sequence diagram below shows a high level description of the invoice process.

sequenceDiagram

Payer->>Merchant: Start purchase

activate Merchant

note left of Merchant: First API request

Merchant->>-SwedbankPay: POST /psp/invoice/payments ①

activate SwedbankPay

SwedbankPay-->>-Merchant: rel: view-authorization ②

activate Merchant

Merchant-->>-Payer: Display all details and final price

activate Payer

note left of Payer: Open iframe ③

Payer->>Payer: Input email and mobile number

Payer->>-Merchant: Confirm purchase

activate Merchant

note left of Merchant: Second API request

Merchant->>-SwedbankPay: Post psp/invoice/authorization ④

activate SwedbankPay

SwedbankPay-->>-Merchant: Transaction result

activate Merchant

note left of Merchant: Third API request

Merchant->>-SwedbankPay: GET <payment.id> ⑤

activate SwedbankPay

SwedbankPay-->>-Merchant: payment resource

activate Merchant

Merchant-->>-Payer: Display result

Note that the invoice will not be created/distributed before you have

made a capture request.