This feature is only available for merchants who have a specific agreement with Swedbank Pay.

Introduction

At the moment, our payout offering consists of Trustly Payout only, but this may be expanding going forward.

There are two alternatives for implementing Trustly Payout. Select Account and Register Account. Both alternatives consist of two parts, a setup and a server-to-server call which actually triggers the payout.

The setup procedures of the two options differ somewhat, so we will describe them separately. The actual payout procedure is the same, and will be described as one.

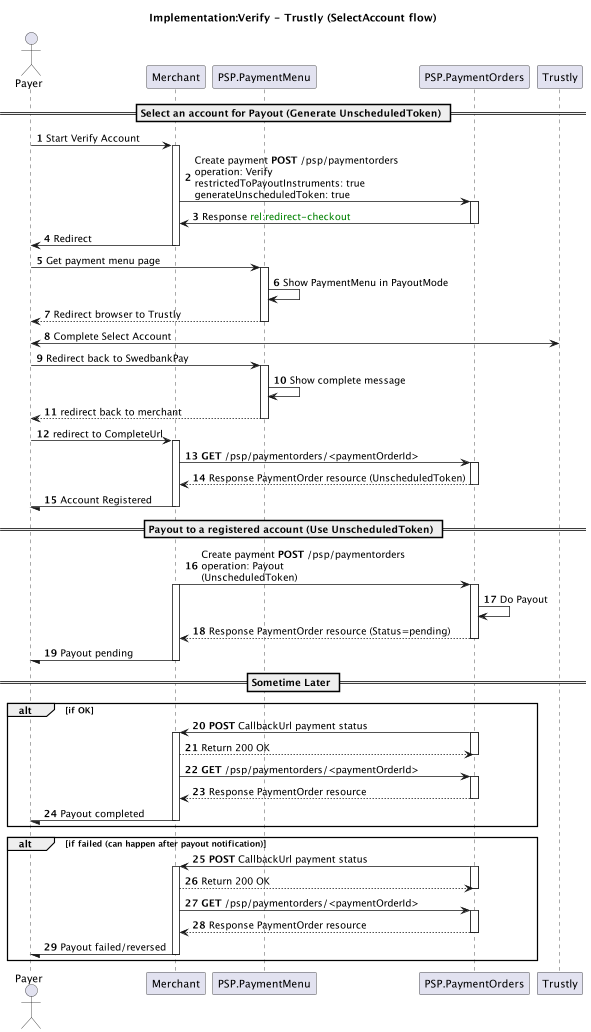

Select Account

Select Account should be used for all consumers who will need to pick their payout account. The initial setup handles the UI part where the payer chooses their bank account. This endpoint will return a token that can be used to represent that bank account for that payer. The second part is, as mentioned before, a server-to-server endpoint where the actual payout is triggered. This lets you reuse the token multiple times if that is desired.

Select Account Setup

The initial setup can be done at an earlier time than the actual payout.

- The payer initiates the payout process on your site.

- You will have to initiate a

PaymentOrdertowards Swedbank Pay to start the payout process. It is important to set“operation=Verify”,generateUnscheduledToken=trueandrestrictedToPayoutInstruments=true. - The response will include an operation with a

rel:redirect-checkoutor arel:view-checkout. This is where you need to redirect the payer, or display in your UI, to let them choose their bank account. - Redirect payer’s browser to

redirect-paymentmenuor display therel:view-checkout. - The Swedbank Pay payment UI will be loaded in Payout mode.

- The only option for the payer is to choose Trustly, as this is the only available payout alternative to date.

- The payer’s browser will be redirected to Trustly.

- The payer will identify themselves by BankId and choose the bank account where they want to receive the money.

- The payer is then redirected back to Swedbank Pay.

- Swedbank Pay will validate that we have received the bank account information before showing the OK message.

- The payer is redirected back to the

completeUrlprovided in the initial call. - The payer’s browser is connected to the

completeUrl. - You then need to do a

GETto check the status of the payout. - You will receive a

PaymentOrderresponse model. You can check that the status is set toPaid. If thePaymentOrderis aborted or failed, something went wrong and the attempt was unsuccessful. You will get theUnscheduledTokenin the model’s paid node. - Return status to the payer about the status.

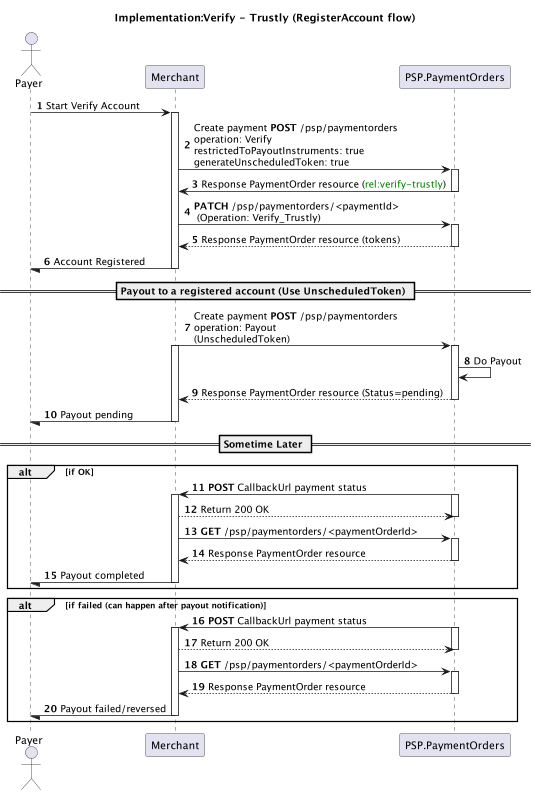

Register Account

Register Account should be used for payouts to other business entities. This implementation requires that you already have all account information for the receiving payout account. There is no interaction needed by the receiving part in this flow.

Register Account Setup

- You or the customer will trigger the payout process.

- You will have to initiate a

PaymentOrdertowards Swedbank Pay to start the payout process. It is important to setoperation=Verify,generateUnscheduledToken=true,restrictedToPayoutInstruments=true. - The response will include an operation with a

rel:verify-trustly. This is where you need to do a call to register the bank account. - Do a call to the

verify-trustlyendpoint to register the bank account details. - The response will have

status=Paidif everything is completed. TheunscheduledTokenwill be provided in the response model’sPaidnode. - If desired, you can notify the payer that the bank account is registered.

The Server-To-Server Payout Call

- When it is time to do a payout, you must initiate a new payment order. This

time there is no interaction with the payer, so it will be handled as a

server-to-server call. You must set

operation=PayoutandunscheduledToken=<token>. It is also important to include acallbackUrlas this call is async and will use callbacks to communicate status changes. - Swedbank Pay will initiate the payout process against Trustly.

- You will get a response that the

PaymentOrderis initialized. The reason for this is that it takes some time before the payout is completed. - If you wish, you can now communicate to the payer that the payout is registered, but not finished.

It will take some time before a payout is either OK or Failed. There can also

be edge cases where the payout will get the Paid status first, and changed

to failed later. It is important to design the system to handle these

scenarios. If the payout is complete the following flow will happen:

- You will get a callback.

- You will need to answer the callback with an acknowledge message.

- You need to do a

GETon thePaymentOrderto check the status. - It must have

status=Paidif the payout was successful. - You can now inform the payer that the payout was successful.

If something failed in the payout process this flow will happen.

- If the payout failed, you will get a callback.

- You will need to answer the callback with an acknowledge message.

- You need to do a GET on the

PaymentOrderto check the status. - It will have

status=Abortedif the payout failed. - You can now inform the payer that the payout has failed and that you will try to do the payout again.

Verify Request

Request

1

2

3

4

POST /psp/paymentorders HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json;version=3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

{

"paymentorder": {

"restrictedToPayoutInstruments": true,

"generateUnscheduledToken": true,

"operation": "Verify",

"productName": "Checkout3",

"currency": "SEK",

"description": "Bank account verification",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"urls": {

"completeUrl": "http://complete.url",

"hostUrls": ["http://testmerchant.url"],

"cancelUrl": "http://cancel.url"

},

"payeeInfo": {

"payeeId": "",

"payeeReference": "",

"payeeName": "Testmerchant"

},

"payer": {

"payerReference": "",

"firstName": "Example",

"lastName": "Name",

"nationalIdentifier": {

"socialSecurityNumber": "199710202392",

"countryCode": "SE"

},

"email": "test@swedbankpay.com",

"msisdn": "+46709876543",

"address": {

"streetAddress": "Main Street 1",

"coAddress": "Apartment 123, 2 stairs up",

"city": "Stockholm",

"zipCode": "SE-11253",

"countryCode": "SE"

}

}

}

}

paymentOrder

object

check

operation

string

check

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

Must be set toVerify.

productName

string

check

Checkout3. Mandatory for Online Payments v3.0, either in this field or the header, as you won't get the operations in the response without submitting this field.

currency

string

check

restrictedToPayoutInstruments

bool

check

true to only show Payout enabled payment methods (Trustly).

generateUnscheduledToken

bool

check

true.

description

string

check

userAgent

string

check

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

string

check

urls

object

check

urls object, containing the URLs relevant for the payment order.

hostUrls

array

check

completeUrl

string

check

The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment order to inspect it further. See completeUrl for details.

cancelUrl

string

check

abort request of the payment or paymentorder.

payeeInfo

object

check

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details.

payeeId

string

check

payeeReference

string(30)

check

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. In Invoice Payments payeeReference is used as an invoice/receipt number, if the receiptReference is not defined.

payeeName

string

payer

object

payer object containing information about the payer relevant for the payment order.

payerReference

string

firstName

string

check

lastName

string

nationalIdentifier

object

restrictedToSocialSecurityNumber parameter.

socialSecurityNumber

string

countryCode

string

email

string

msisdn

string

address

object

streetAddress

string

coAddress

string

city

string

zipCode

string

countryCode

string

SE, NO, or FI.Verify Response

Note the new operation verify-trustly, which is available if it is activated

in the merchant’s contract and the payer’s first and last name is added in the

request.

Response

1

2

3

HTTP/1.1 200 OK

Content-Type: application/json; charset=utf-8; version=3.x/2.0

api-supported-versions: 3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

{

"paymentOrder": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644",

"created": "2023-06-09T07:26:27.3013437Z",

"updated": "2023-06-09T07:26:28.6979343Z",

"operation": "Verify",

"status": "Initialized",

"currency": "SEK",

"amount": 510,

"vatAmount": 0,

"description": "Test Verification",

"initiatingSystemUserAgent": "PostmanRuntime/7.32.2",

"language": "nb-NO",

"availableInstruments": [

"Trustly"

],

"implementation": "PaymentsOnly",

"integration": "",

"instrumentMode": false,

"guestMode": false,

"urls": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/urls"

},

"payeeInfo": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/payeeinfo"

},

"payer": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/payers"

},

"history": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/history"

},

"failed": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/failed"

},

"aborted": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/aborted"

},

"paid": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/paid"

},

"cancelled": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/cancelled"

},

"financialTransactions": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/financialtransactions"

},

"failedAttempts": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/failedattempts"

},

"metadata": {

"id": "/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644/metadata"

}

},

"operations": [

{

"method": "PATCH",

"href": "https://api.stage.payex.com/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644",

"rel": "update-order",

"contentType": "application/json"

},

{

"method": "PATCH",

"href": "https://api.stage.payex.com/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644",

"rel": "abort",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://ecom.stage.payex.com/checkout/a8ff4fa9821b500dbb657bcba68422e20b9ba8dd2652bbc3f0f456b93774023f?_tc_tid=96f4d7cef4984a84b380e5478b7f6632",

"rel": "redirect-checkout",

"contentType": "text/html"

},

{

"method": "GET",

"href": "https://ecom.stage.payex.com/checkout/core/client/checkout/a8ff4fa9821b500dbb657bcba68422e20b9ba8dd2652bbc3f0f456b93774023f?culture=nb-NO&_tc_tid=96f4d7cef4984a84b380e5478b7f6632",

"rel": "view-checkout",

"contentType": "application/javascript"

},

{

"method": "PATCH",

"href": "https://api.stage.payex.com/psp/paymentorders/b60d08b8-0509-4abf-a722-08db68bad644",

"rel": "verify-trustly",

"contentType": "application/json"

}

]

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

created

date(string)

updated

date(string)

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

status

string

Initialized is returned when the payment is created and still ongoing. The request example above has this status. Paid is returned when the payer has completed the payment successfully. See the Paid response. Failed is returned when a payment has failed. You will find an error message in the Failed response. Cancelled is returned when an authorized amount has been fully cancelled. See the Cancelled response. It will contain fields from both the cancelled description and paid section. Aborted is returned when the merchant has aborted the payment, or if the payer cancelled the payment in the redirect integration (on the redirect page). See the Aborted response.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

initiatingSystemUserAgent

string

The user agent of the HTTP client making the request, reflecting the value sent in the User-Agent header with the initial POST request which created the Payment Order.

language

string

Allowed locale code values: sv-SE, nb-NO, da-DK, en-US or fi-FI.

availableInstruments

string

implementation

string

Enterprise or PaymentsOnly. We ask that you don't build logic around this field's response. It is mainly for information purposes, as the implementation types might be subject to name changes. If this should happen, updated information will be available in this table.

integration

string

HostedView (Seamless View) or Redirect. This field will not be populated until the payer has opened the payment UI, and the client script has identified if Swedbank Pay or another URI is hosting the container with the payment iframe. We ask that you don't build logic around this field's response. It is mainly for information purposes. as the integration types might be subject to name changes, If this should happen, updated information will be available in this table.

instrumentMode

bool

true or false. Indicates if the payment is initialized with only one payment methods available.

guestMode

bool

true or false. Indicates if the payer chose to pay as a guest or not. When using the Payments Only implementation, this is triggered by not including a payerReference in the original paymentOrder request.

urls

id

urls resource where all URLs related to the payment order can be retrieved.

payeeInfo

id

payeeInfo resource where information related to the payee can be retrieved.

payer

id

payer resource where information about the payer can be retrieved.

history

id

history resource where information about the payment's history can be retrieved.

failed

id

failed resource where information about the failed transactions can be retrieved.

aborted

id

aborted resource where information about the aborted transactions can be retrieved.

paid

id

paid resource where information about the paid transactions can be retrieved.

cancelled

id

cancelled resource where information about the cancelled transactions can be retrieved.

financialTransactions

id

financialTransactions resource where information about the financial transactions can be retrieved.

failedAttempts

id

failedAttempts resource where information about the failed attempts can be retrieved.

metadata

id

metadata resource where information about the metadata can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

PATCH Verify Request

The PATCH request towards the verify-trustly operation, containing the bank

account details.

Request

1

2

3

4

PATCH /psp/paymentorders HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json;version=3.x/2.0

1

2

3

4

5

6

7

8

{

"paymentorder": {

"operation": "VerifyTrustly",

"clearingHouse": "SWEDEN",

"bankNumber": "6112",

"accountNumber": "69706212"

}

}

paymentOrder

object

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

clearingHouse

string

bankNumber

string

""). For non-IBAN, see the example in our request or the bank number format table.

accountNumber

string

PATCH Verify Response

Note that the status in the response has changed to Paid, with the correlating

disappearance of PATCH operations.

Response

1

2

3

HTTP/1.1 200 OK

Content-Type: application/json; charset=utf-8; version=3.x/2.0

api-supported-versions: 3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

{

"paymentOrder": {

"id": "/psp/paymentorders/<id>",

"created": "2023-07-06T05:42:07.7531238Z",

"updated": "2023-07-06T05:42:14.6086749Z",

"operation": "Verify",

"status": "Paid",

"currency": "SEK",

"amount": 510,

"vatAmount": 0,

"description": "Test Verification",

"initiatingSystemUserAgent": "PostmanRuntime/7.32.3",

"language": "nb-NO",

"availableInstruments": [

"Trustly"

],

"implementation": "PaymentsOnly",

"integration": "",

"instrumentMode": false,

"guestMode": true,

"urls": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/urls"

},

"payeeInfo": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/payeeinfo"

},

"payer": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/payers"

},

"history": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/history"

},

"failed": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/failed"

},

"aborted": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/aborted"

},

"paid": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/paid"

},

"cancelled": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/cancelled"

},

"financialTransactions": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/financialtransactions"

},

"failedAttempts": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/failedattempts"

},

"metadata": {

"id": "/psp/paymentorders/1e7e8e00-dc76-4ea5-0d7d-08db7c962a83/metadata"

}

},

"operations": "operations": [

{

"method": "GET",

"href": "https://ecom.stage.payex.com/checkout/a8ff4fa9821b500dbb657bcba68422e20b9ba8dd2652bbc3f0f456b93774023f?_tc_tid=96f4d7cef4984a84b380e5478b7f6632",

"rel": "redirect-checkout",

"contentType": "text/html"

},

{

"method": "GET",

"href": "https://ecom.stage.payex.com/checkout/core/client/checkout/a8ff4fa9821b500dbb657bcba68422e20b9ba8dd2652bbc3f0f456b93774023f?culture=nb-NO&_tc_tid=96f4d7cef4984a84b380e5478b7f6632",

"rel": "view-checkout",

"contentType": "application/javascript"

}

]

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

created

date(string)

updated

date(string)

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

status

string

Initialized is returned when the payment is created and still ongoing. The request example above has this status. Paid is returned when the payer has completed the payment successfully. See the Paid response. Failed is returned when a payment has failed. You will find an error message in the Failed response. Cancelled is returned when an authorized amount has been fully cancelled. See the Cancelled response. It will contain fields from both the cancelled description and paid section. Aborted is returned when the merchant has aborted the payment, or if the payer cancelled the payment in the redirect integration (on the redirect page). See the Aborted response.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

initiatingSystemUserAgent

string

The user agent of the HTTP client making the request, reflecting the value sent in the User-Agent header with the initial POST request which created the Payment Order.

language

string

Allowed locale code values: sv-SE, nb-NO, da-DK, en-US or fi-FI.

availableInstruments

string

implementation

string

Enterprise or PaymentsOnly. We ask that you don't build logic around this field's response. It is mainly for information purposes, as the implementation types might be subject to name changes. If this should happen, updated information will be available in this table.

integration

string

HostedView (Seamless View) or Redirect. This field will not be populated until the payer has opened the payment UI, and the client script has identified if Swedbank Pay or another URI is hosting the container with the payment iframe. We ask that you don't build logic around this field's response. It is mainly for information purposes. as the integration types might be subject to name changes, If this should happen, updated information will be available in this table.

instrumentMode

bool

true or false. Indicates if the payment is initialized with only one payment method available.

guestMode

bool

true or false. Indicates if the payer chose to pay as a guest or not. When using the Payments Only implementation, this is triggered by not including a payerReference in the original paymentOrder request.

urls

id

urls resource where all URLs related to the payment order can be retrieved.

payeeInfo

id

payeeInfo resource where information related to the payee can be retrieved.

payer

id

payer resource where information about the payer can be retrieved.

history

id

history resource where information about the payment's history can be retrieved.

failed

id

failed resource where information about the failed transactions can be retrieved.

aborted

id

aborted resource where information about the aborted transactions can be retrieved.

paid

id

paid resource where information about the paid transactions can be retrieved.

cancelled

id

cancelled resource where information about the cancelled transactions can be retrieved.

financialTransactions

id

financialTransactions resource where information about the financial transactions can be retrieved.

failedAttempts

id

failedAttempts resource where information about the failed attempts can be retrieved.

metadata

id

metadata resource where information about the metadata can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

Payout Request

Request

1

2

3

4

POST /psp/paymentorders HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json;version=3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

{

"paymentorder": {

"operation": "Payout",

"productName": "Checkout3",

"currency": "SEK",

"amount": 1500,

"vatAmount": 0,

"unscheduledToken": "",

"description": "Bank account verification",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"urls": {

"callbackUrl": "http://callback.url"

},

"payeeInfo": {

"payeeId": "",

"payeeReference": "",

"payeeName": "Testmerchant"

},

"payer": {

"payerReference": ""

}

}

}

paymentOrder

object

check

operation

string

check

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

Must be set toPayout.

productName

string

check

Checkout3. Mandatory for Online Payments v3.0, either in this field or the header, as you won't get the operations in the response without submitting this field.

currency

string

check

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

unscheduledToken

string

description

string

check

userAgent

string

check

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

string

check

urls

object

check

urls object, containing the URLs relevant for the payment order.

callbackUrl

string

check

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment order. See callback for details.

payeeInfo

object

check

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details.

payeeId

string

check

payeeReference

string(30)

check

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. In Invoice Payments payeeReference is used as an invoice/receipt number, if the receiptReference is not defined.

payeeName

string

payer

object

payer object containing information about the payer relevant for the payment order.

payerReference

string

Payout Response

Response

1

2

3

HTTP/1.1 200 OK

Content-Type: application/json; charset=utf-8; version=3.x/2.0

api-supported-versions: 3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

{

"paymentOrder": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08",

"created": "2023-06-09T07:35:35.1855792Z",

"updated": "2023-06-09T07:35:35.6863019Z",

"operation": "Payout",

"status": "Initialized",

"currency": "SEK",

"amount": 2147483647,

"vatAmount": 0,

"description": "Test Purchase",

"initiatingSystemUserAgent": "PostmanRuntime/7.32.2",

"language": "sv-SE",

"availableInstruments": [],

"implementation": "PaymentsOnly",

"integration": "",

"instrumentMode": false,

"guestMode": true,

"orderItems": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/orderitems"

},

"urls": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/urls"

},

"payeeInfo": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/payeeinfo"

},

"history": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/history"

},

"failed": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/failed"

},

"aborted": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/aborted"

},

"paid": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/paid"

},

"cancelled": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/cancelled"

},

"financialTransactions": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/financialtransactions"

},

"failedAttempts": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/failedattempts"

},

"metadata": {

"id": "/psp/paymentorders/f4e47e61-37a5-4281-a5f3-08db68bc1d08/metadata"

}

},

"operations": []

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

created

date(string)

updated

date(string)

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

status

string

Initialized is returned when the payment is created and still ongoing. The request example above has this status. Paid is returned when the payer has completed the payment successfully. See the Paid response. Failed is returned when a payment has failed. You will find an error message in the Failed response. Cancelled is returned when an authorized amount has been fully cancelled. See the Cancelled response. It will contain fields from both the cancelled description and paid section. Aborted is returned when the merchant has aborted the payment, or if the payer cancelled the payment in the redirect integration (on the redirect page). See the Aborted response.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

initiatingSystemUserAgent

string

The user agent of the HTTP client making the request, reflecting the value sent in the User-Agent header with the initial POST request which created the Payment Order.

language

string

Allowed locale code values: sv-SE, nb-NO, da-DK, en-US or fi-FI.

availableInstruments

string

implementation

string

Enterprise or PaymentsOnly. We ask that you don't build logic around this field's response. It is mainly for information purposes, as the implementation types might be subject to name changes. If this should happen, updated information will be available in this table.

integration

string

HostedView (Seamless View) or Redirect. This field will not be populated until the payer has opened the payment UI, and the client script has identified if Swedbank Pay or another URI is hosting the container with the payment iframe. We ask that you don't build logic around this field's response. It is mainly for information purposes. as the integration types might be subject to name changes, If this should happen, updated information will be available in this table.

instrumentMode

bool

true or false. Indicates if the payment is initialized with only one payment method available.

guestMode

bool

true or false. Indicates if the payer chose to pay as a guest or not. When using the Payments Only implementation, this is triggered by not including a payerReference in the original paymentOrder request.

orderItems

id

orderItems resource where information about the order items can be retrieved.

urls

id

urls resource where all URLs related to the payment order can be retrieved.

payeeInfo

id

payeeInfo resource where information related to the payee can be retrieved.

payer

id

payer resource where information about the payer can be retrieved.

history

id

history resource where information about the payment's history can be retrieved.

failed

id

failed resource where information about the failed transactions can be retrieved.

aborted

id

aborted resource where information about the aborted transactions can be retrieved.

paid

id

paid resource where information about the paid transactions can be retrieved.

cancelled

id

cancelled resource where information about the cancelled transactions can be retrieved.

financialTransactions

id

financialTransactions resource where information about the financial transactions can be retrieved.

failedAttempts

ic

failedAttempts resource where information about the failed attempts can be retrieved.

metadata

id

metadata resource where information about the metadata can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

GET Payment Order

A GET performed after the callback is received on a paymentOrder with status

Paid. A field called trustlyOrderId will appear among the details in the

Paid node. This can be used for support correspondance.

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json;version=3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

{

"paymentOrder": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08",

"created": "2023-06-09T07:38:08.5041489Z",

"updated": "2023-06-09T07:38:25.3627725Z",

"operation": "Payout",

"status": "Paid",

"currency": "SEK",

"amount": 1000,

"vatAmount": 0,

"remainingReversalAmount": 1000,

"description": "Test Purchase",

"initiatingSystemUserAgent": "PostmanRuntime/7.32.2",

"language": "sv-SE",

"availableInstruments": [],

"implementation": "PaymentsOnly",

"integration": "",

"instrumentMode": false,

"guestMode": true,

"urls": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/urls",

"callbackUrl": "http://test-dummy.net/payment-callback"

},

"payeeInfo": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/payeeinfo"

},

"history": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/history"

},

"failed": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/failed"

},

"aborted": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/aborted"

},

"paid": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/paid"

"instrument": "Trustly",

"number": 79100113652,

"payeeReference": "1662373401",

"orderReference": "orderReference",

"transactionType": "Sale",

"amount": 1500,

"tokens": [

{

"type": "Unscheduled",

"token": "6d495aac-cb2b-4d94-a5f1-577baa143f2c",

"name": "492500******0004",

"expiryDate": "02/2023"

}

],

"submittedAmount": 1500,

"feeAmount": 0,

"discountAmount": 0,

"details": {

"trustlyOrderId": 123456789

}

},

"cancelled": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/cancelled"

},

"financialTransactions": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/financialtransactions"

},

"failedAttempts": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/failedattempts"

},

"metadata": {

"id": "/psp/paymentorders/3c265183-e7ee-438b-a5f4-08db68bc1d08/metadata"

}

},

"operations": []

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

created

date(string)

updated

date(string)

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

status

string

Initialized is returned when the payment is created and still ongoing. The request example above has this status. Paid is returned when the payer has completed the payment successfully. See the Paid response. Failed is returned when a payment has failed. You will find an error message in the Failed response. Cancelled is returned when an authorized amount has been fully cancelled. See the Cancelled response. It will contain fields from both the cancelled description and paid section. Aborted is returned when the merchant has aborted the payment, or if the payer cancelled the payment in the redirect integration (on the redirect page). See the Aborted response.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

initiatingSystemUserAgent

string

The user agent of the HTTP client making the request, reflecting the value sent in the User-Agent header with the initial POST request which created the Payment Order.

language

string

Allowed locale code values: sv-SE, nb-NO, da-DK, en-US or fi-FI.

availableInstruments

string

implementation

string

Enterprise or PaymentsOnly. We ask that you don't build logic around this field's response. It is mainly for information purposes, as the implementation types might be subject to name changes. If this should happen, updated information will be available in this table.

integration

string

HostedView (Seamless View) or Redirect. This field will not be populated until the payer has opened the payment UI, and the client script has identified if Swedbank Pay or another URI is hosting the container with the payment iframe. We ask that you don't build logic around this field's response. It is mainly for information purposes. as the integration types might be subject to name changes, If this should happen, updated information will be available in this table.

instrumentMode

bool

true or false. Indicates if the payment is initialized with only one payment method available.

guestMode

bool

true or false. Indicates if the payer chose to pay as a guest or not. When using the Payments Only implementation, this is triggered by not including a payerReference in the original paymentOrder request.

urls

string

urls resource where all URLs related to the payment order can be retrieved.

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

callbackUrl

string

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment order. See callback for details.

payeeInfo

object

payer

string

payer resource where information about the payer can be retrieved.

history

string

history resource where information about the payment's history can be retrieved.

failed

string

failed resource where information about the failed transactions can be retrieved.

aborted

string

aborted resource where information about the aborted transactions can be retrieved.

paid

string

paid resource where information about the paid transactions can be retrieved.

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

instrument

string

capture is needed, we recommend using operations or the transactionType field.

number

integer

The transaction number, useful when there’s need to reference the transaction in human communication. Not usable for programmatic identification of the transaction, where id should be used instead.

payeeReference

string(30)

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits.

transactionType

string

Authorization or Sale. Can be used to understand if there is a need for doing a capture on this payment order. Swedbank Pay recommends using the different operations to figure out if a capture is needed.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The amount displayed is the final amount the payer paid for their order, including any payment method specific discounts or fees.

tokens

integer

type

string

payment, recurrence, transactionOnFile or unscheduled. The different types of available tokens.

token

string

guid.

name

string

expiryDate

string

feeAmount

integer

discountAmount

integer

details

integer

trustlyOrderId

string

cancelled

id

cancelled resource where information about the cancelled transactions can be retrieved.

financialTransactions

id

financialTransactions resource where information about the financial transactions can be retrieved.

failedAttempts

id

failedAttempts resource where information about the failed attempts can be retrieved.

metadata

id

metadata resource where information about the metadata can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

Select Account Flow

Register Account Flow

(https://eu.developers.trustly.com/doc/reference/registeraccount#accountnumber-format)